How the Rich Exploit Tax Loopholes & Pay No Taxes

IRS documents show Bezos, Musk and Buffett pay almost no taxes.

We now have a map of how the wealthiest people exploit it thanks to a bombshell report from ProPublica, the investigative journalism nonprofit, which claims to have obtained years of tax returns for the wealthiest people in the country from an anonymous source.

Robert Reich has a special Tax Day message, explaining why the wealthiest 1% pay a much lower tax rate than the rest of us

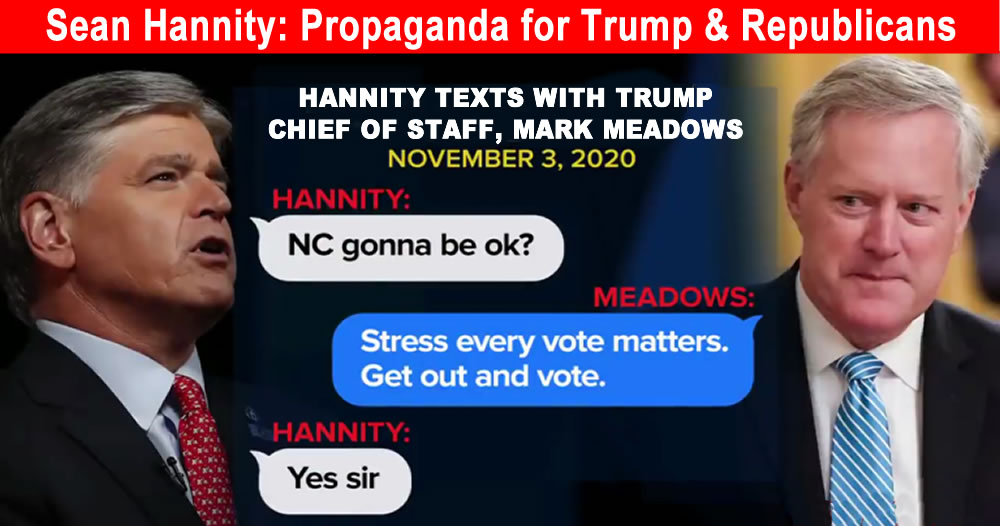

Rush Limbaugh, Glenn Beck and Sean Hannity are paid millions of dollars a year. It’s no wonder they are staunch defenders of the rich and tax cuts for the rich.

It also explains why they say anything to keep being paid those millions

The Republican Party Exists to Protect Millionaires and Billionaires

The Republican Party’s attacks on the IRS budget are depriving the government of revenue, according to a new Atlantic-ProPublica report.

The Republican Party Exists to Protect Millionaires and Billionaires

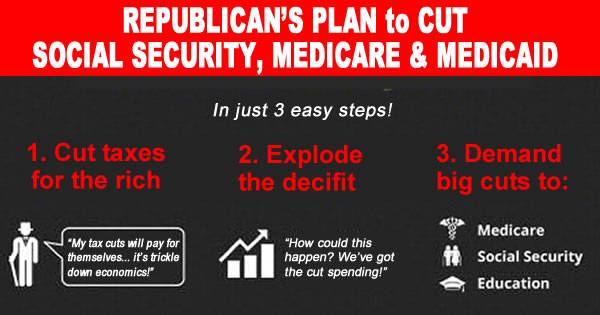

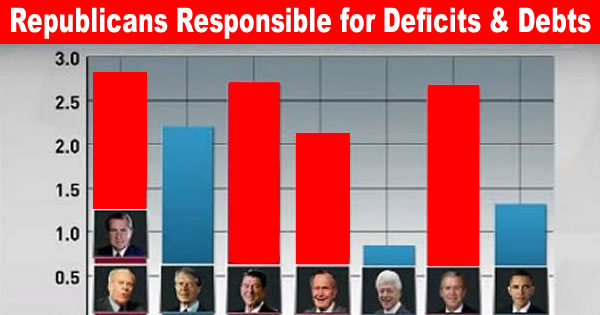

Per the above article: “Other than “downplaying federal crimes committed by the president,” the modern Republican Party cherishes nothing more than finding innovative ways to lighten the financial burdens of the millionaires and billionaires who support it. This is most evident, of course, in its signature accomplishment of the 115th Congress: a $1.5 trillion tax cut for very wealthy people, propped up by the usual gamut of vague, Reaganomics-type assurances that the gaping new hole in the federal deficit would “pay for itself.”

An astonishing new report from The Atlantic and ProPublica, however, reveals that the party’s most prominent display of corporate generosity is not necessarily the most lucrative one. Thanks to the GOP’s decades-long war on the Internal Revenue Service, the federal government’s ability to collect legally-owed taxes has reached a historical nadir, as deep budget cuts have hamstrung efforts to fulfill basic responsibilities—like, among many others, hiring professionals to catch people who might be good at evading taxes.

Corporations and the wealthy are the biggest beneficiaries of the IRS’s decay. Most Americans’ interaction with the IRS is largely automated. But it takes specialized, well-trained personnel to audit a business or a billionaire or to unravel a tax scheme—and those employees are leaving in droves and taking their expertise with them. For the country’s largest corporations, the danger of being hit with a billion-dollar tax bill has greatly diminished. For the rich, who research shows evade taxes the most, the IRS has become less and less of a force to be feared”.