Republicans Are For The $RICH$

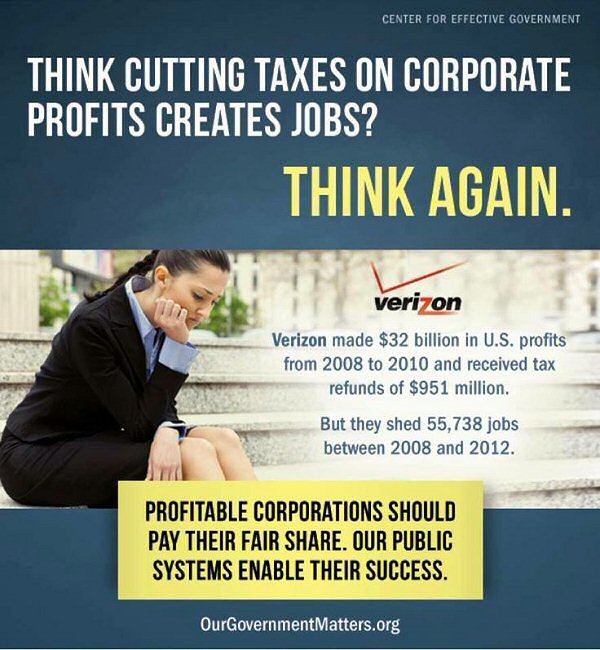

Why Tax Breaks For the Rich Don’t Create Jobs

Republicans tax cuts which benefit the RICH show how Republicans are bought and paid for by the RICH and only care about the RICH

Trump’s leaked speech about making the rich even richer. Behind closed doors, he tells his billionaire friends he’ll make them even richer.

Trump Promises to Keep Billionaires Taxes Low

Mitch McConnell Makes Shocking Admission That Wealthy Donors Own Republican Senators

Republican Senator Josh Hawley has introduced a piece of legislation that would ban publicly-traded companies from spending money on politics, and Senate minority leader Mitch McConnell is absolutely furious. According to reports, McConnell snapped at Hawley during a Republican lunch meeting this week, and McConnell reminded Hawley that without big money donors they wouldn’t have seats in the Senate. This is a clear admission that wealthy donors are buying seats for Republicans.

Trump will cut taxes for billionaires and stick you with the bill.

Larry Elder Thinks California’s Minimum Wage Should Be $0 an Hour

The gubernatorial recall candidate said in an interview that the state’s workers guaranteed a base pay of zilch

REPUBLICAN Candidate for Governor of California, Larry Elder thinks California’s Minimum Wage should be $0 an Hour

President Harry Truman explains the difference between Republicans & Democrats at the 1948 Democratic Convention

REPUBLICAN Senator Ron Johnson caught Protecting the RICH

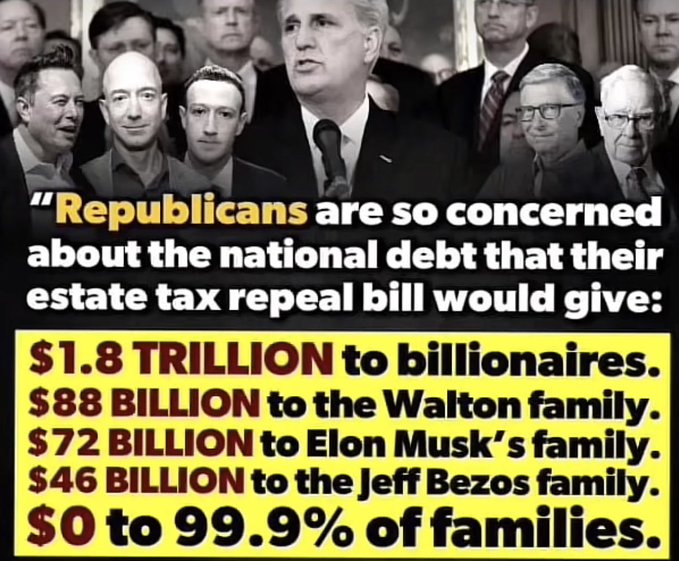

KEVIN MCCARTHY & REPUBLICANS ARE FOR THE RICH!

How Tax Breaks Helps the RICH

Republicans are Corporate Boot-lickers who are bought & paid for by the RICH

The above video exposes how Republicans are hypocrites who engage in, and condone Socialism for the Rich in the form of corporate bails-outs, tax payer funded sports stadiums, farm subsidies (22 billion in 2019 when Trump was President), but harsh “pull yourself by up by your own bootstraps” Capitalism for everyone else.

Secrets the Rich don’t Want You to Know

Video shows how Reaganomics and tax breaks for the rich don’t work. Paul Ryan and Republicans are Bought and Paid for by the Rich.

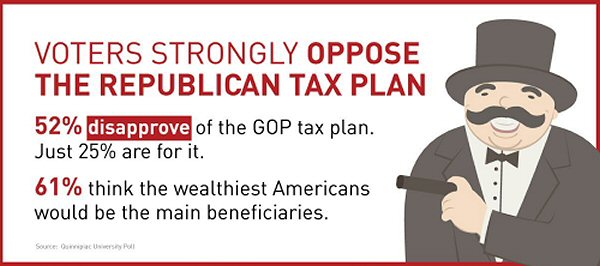

Republicans Plan To EXPLODE The Deficit With New Tax Cuts For Rich

The new Republican tax cut plan, written by Vern Buchanan, would add $3.5 TRILLION to the deficit and would be a historic wealth transfer from the working class. May 25, 2023

Republicans Tax Cut Is a Scam which only benefits the Rich, doesn’t help create jobs and is the worst domestic policy legislation in a lifetime

Who gains and who loses under the GOP’s tax bill

GOP Tax Bill Is Biggest Transfer To The Wealthy In U.S. History

President Trump doesn’t want his voters to know what’s in the GOP Tax bill because it is exactly the opposite of what he campaigned for and is the biggest transfer of wealth to the richest Americans in U.S. history.

Trump’s claims that he would not benefit under the GOP Tax plan is a lie as shown in the above video.

GOP Like ‘Pigs At The Trough’ Of Donald Trump’s Tax Bill

Lawrence O’Donnell compares the behavior of Republican Senators who will be enriched by the Trump-GOP tax bill to Senators he worked with who would have been “embarrassed” by serving special interests.

Americans brace for fallout from GOP tax bill: corporations happy

The concerns that Americans are facing now that Republicans have passed their tax bill, and the new windfall banks and telecoms are eager to enjoy.

Mitch McConnell: Bought and paid for by Special Interest Lobbyists

Sherrod Brown Exposes GOP Tax Bill Dirty Secrets

Sherrod Brown blasts the GOP Tax Cuts

Ohio Democrat Sen. Sherrod Brown calls out Republicans “War on Workers”

Paul Ryan Collected $500,000 In Koch Contributions Days After House Passed Tax Law

That’s peanuts compared with what the Koch brothers will save.

Paul Ryan Collected $500,000 In Koch Contributions

Republican tax proposal steals from the poor to give to the rich

Ten years ago Vicki Lozano and her husband Ted lived in a lakeside home and owned a string of retail stores in the Sacramento area. Then came 2008 and the worst economic upheaval since the Great Depression.They lost their home and businesses. The stress soon took its toll on their health, too.

Ben & Jerry explains in simple terms who benefits from Trump / GOP Tax Bill and how those cuts effect much needed programs which benefit the poor and middle class

Corporate BOOTLICKER Sean Hannity Whines About The Rich Paying Taxes

Fox Anchor STUNNED When She Suddenly Realizes The GOP Lies For Greed

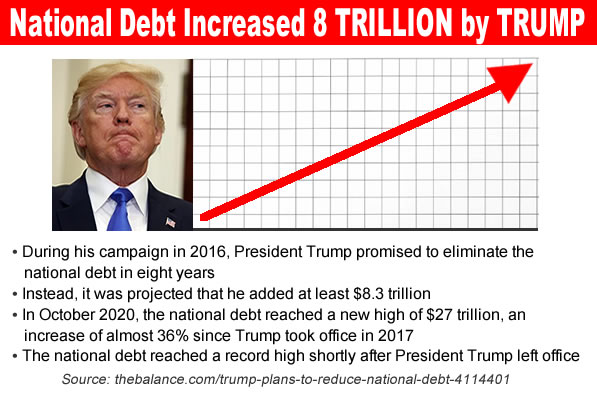

ADDING ANOTHER 1.5 TRILLION TO THE DEBT IS IRRESPONSIBLE OF REPUBLICANS

An Anti-Growth Tax Cut | National Review

Republicans’ proposed $1.5 trillion tax cut is irresponsible and anti-growth.

The National Review and other Conservative publications confirm… adding another 1.5 TRILLION to the debt is IRRESPONSIBLE, especially at a time when tax cuts aren’t needed. We currently have record low UN-employment and a booming economy.

HERE’S THE REAL REASON WHY REPUBLICANS WANT TO THROW THE MIDDLE CLASS, POOR AND SENIORS UNDER THE BUS

Koch network ‘piggy banks’ closed until Republicans pass health and tax reform

Koch officials said that the network’s midterm budget for policy and politics is between $300m and $400m, but donors are demanding legislative progress

Why doesn’t Republicans Care that the Majority of Americans Oppose their Tax Bill?

Thanks to a combination of gerrymandering, voter-suppression techniques, and a seemingly endless amount of campaign contributions, which can be used to tell voters the GOP’s tax bill is the opposite of what it actually is, Republicans may have convinced themselves they can win elections, en masse, whether voters approve of their records or not. They can do as they please because, in their minds, the consent of the governed is now little more than an annoying, irrelevant detail.

Ohio Democrat Senator Sherrod Brown Slams Tax Cuts For Wealthy

Sen. Chuck Schumer Explains the GOP Tax Scam

A new Institute for Policy Studies analysis of major US corporations paying less than 20 percent of earnings in federal corporate income taxes shows that more than half cut jobs since 2008 and increased CEO pay to more than $13 million. Among the companies that slashed jobs? Well their CEOs made more – $15 million.

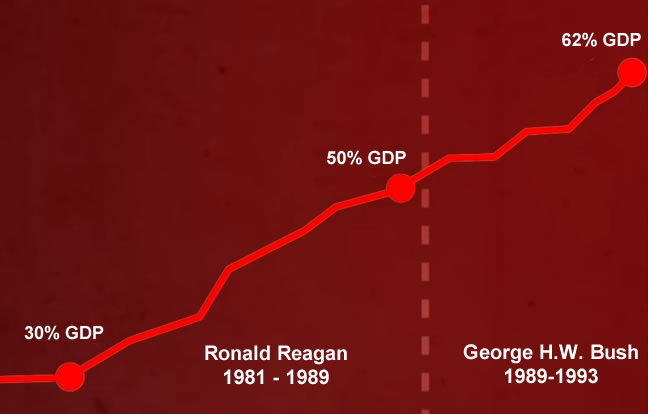

Video explains how Republicans exploded the debt, starting with Ronald Reagan to give tax breaks to the rich.

Per the above article; The fossil fuel industry is a poster child for corporate welfare.

“Federal subsidies and tax breaks prop up fossil fuel development, even when drilling projects should be too expensive to turn a profit. Below-market leasing rates, royalties and fees subsidize oil and gas companies, encouraging them to exploit our public lands and leaving taxpayers on the hook for the environmental damage.

In the “Build Back Better” Act, Congress has an opportunity to make oil and gas corporations play by the same rules as everyone else. The House has included common-sense oil and gas reforms in its version of the bill, and the Senate should follow suit.

Taxpayers should get a fair return from oil and gas companies that drill on publicly owned lands and waters. The House bill would make this change. Right now, these polluters pay below-market rates to extract resources that belong to all Americans.

The federal government’s current 12.5% royalty rate for onshore drilling was established by the Mineral Leasing Act of 1920. It has not been updated for more than a century, even where technological advances have reduced the financial risk of drilling. By contrast, states are far more aggressive in ensuring their taxpayers are not ripped off — even states that tend to be friendly to fossil fuel companies — with Wyoming and Utah collecting about 17% in royalties and Texas going as high as 25%.

Modernizing the federal royalty rate would provide huge benefits to Americans. Taxpayers lost out on more than $12 billion over the past decade because polluters weren’t paying fair market rates for drilling on public lands and waters, according to Taxpayers for Common Sense. Recovering these dollars would enable Congress to allocate more money to other programs in the bill, including those that protect the environment and make it easier for families to afford the rising costs of childcare, pre-K and higher education.

The House’s Build Back Better Act also closes a legal loophole that leaves taxpayers, instead of oil and gas companies, on the hook for cleaning up shut-down wells. Under the current requirements, the bonding coverage that polluters purchase up front to make sure environmental remediation costs are paid doesn’t come close to covering the actual cleanup costs. In effect, that means that oil and gas companies can profit off pollution, then leave taxpayers to deal with the mess they leave behind”.